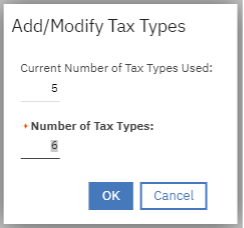

Maximo is set up to allow 5 tax types, which means in tables like PRLINE or POLINE there are 5 tax code fields and 5 tax amount fields for storing the calculated tax after applying the tax rate associated with the tax code. The tax types equate to which of the tax fields are being calculated.

When tax is calculated for the first tax type, TAX1CODE is entered and the TAX1 amount is calculated. The second tax type applies TAX2CODE and calculates the TAX2 amount, but there are options on whether it should include the TAX1 amount before applying the tax rate. There can be up to 27 tax types and this can be updated in

Database Configuration → More Action → Tax Types → Add/Modify Tax Types

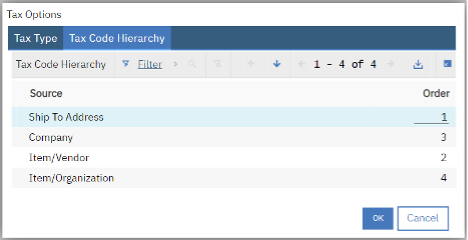

Multiple tax types are often required when an organization works, supplies, or orders goods and services across multiple regions and/or countries. Many users are puzzled how this tax code is being updated in the Purchase Requisition or Purchase order application. Maximo uses a hierarchy order to update the Tax code in the respective application. This hierarchy can be set up in Organizations → More Action → Purchasing Options – Tax Options. This order can be modified based on their business process.

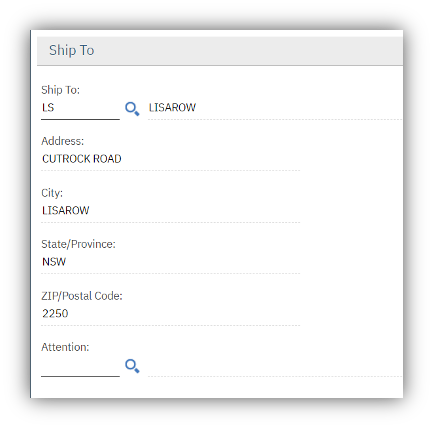

Ship To Address:

Tax code can be set to an address through the Organization application →Address tab. When this address is being pulled into PR or PO, the tax code is copied into the PR or PO lines.

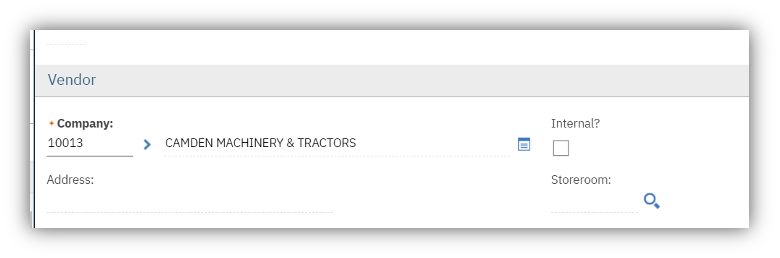

Company:

Tax Code can be set in the Companies application under Purchasing section for a selected a vendor.

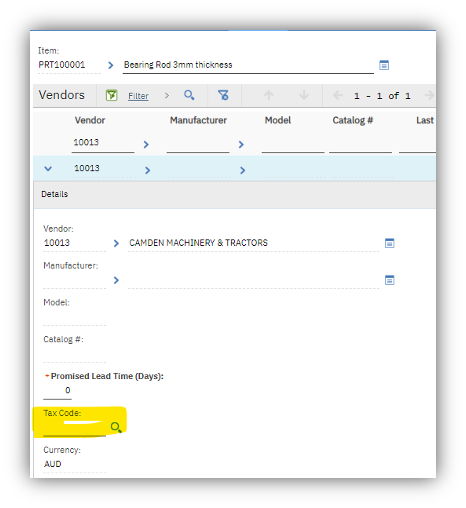

Item/Vendor:

Tax Code can be set to an Item & Vendor combination through Item Master application → Vendor Tab. When a vendor is added to an Item, Tax Code is pulled from the Company application, but this can be changed manually based on the business rules.

Note that this will take priority when the Tax Exempt is flag is unchecked

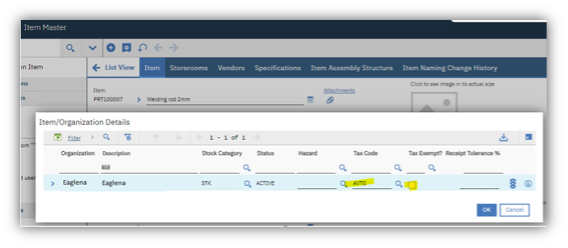

Item/Organization details:

Tax Code can be set to an Item & Organization combination through Item Master application → More Action → Item/Organization Details action. When a vendor is added to an Item, Tax Code is pulled from the Company application, but this can be changed manually based on the business rules.

Note that this will take priority when the Tax Exempt is flag is unchecked

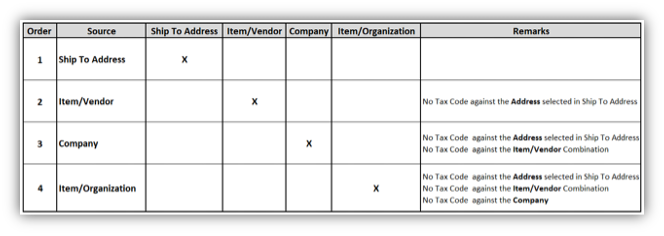

Below tabulation helps the user to identify the hierarchy of updating the tax code in Purchase Requisition, Purchase Order and Invoice application.

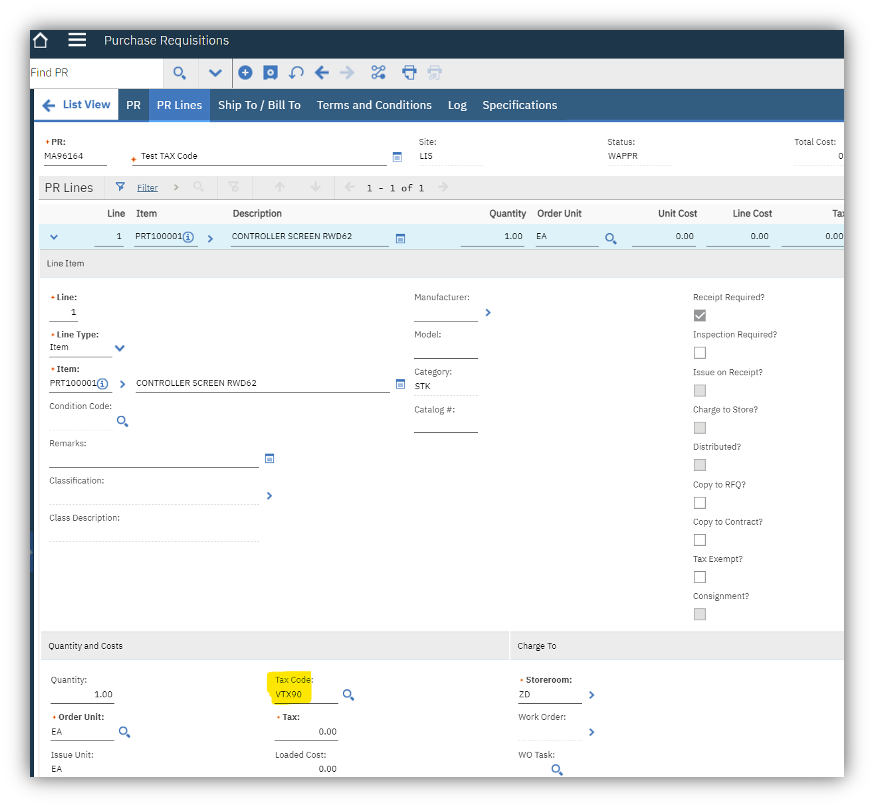

Below example with different scenarios helps us better understanding in updating tax code in PR application.

Below data was set up in the respective applications

| Order | Source | Address | Item | Vendor | Tax Exempt | Tax Code |

| 1 | Ship to Address | LS | - | VTX90 | ||

| 2 | Item/Vendor | PRT100001 | 10013 | NO | VTX01 | |

| 3 | Company | ABC | - | GST | ||

| 4 | Item/Organisation | PRT100007 | NO | AVTO |

PR is created with the above data by updating the mandatory details as below.

When a PR line is created, Maximo updates the tax code VTX90 based on the Ship To address.

| Order | Source | Address | Item | Vendor | Tax Exempt | Tax Code |

| 1 | Ship to Address | LS | - | |||

| 2 | Item/Vendor | PRT100001 | 10013 | NO | VTX01 | |

| 3 | Company | ABC | - | GST | ||

| 4 | Item/Organisation | PRT100007 | NO | AVTO |

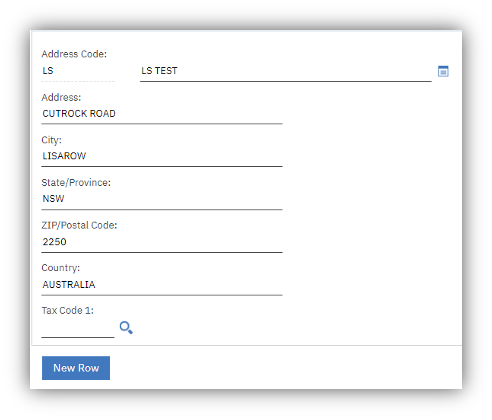

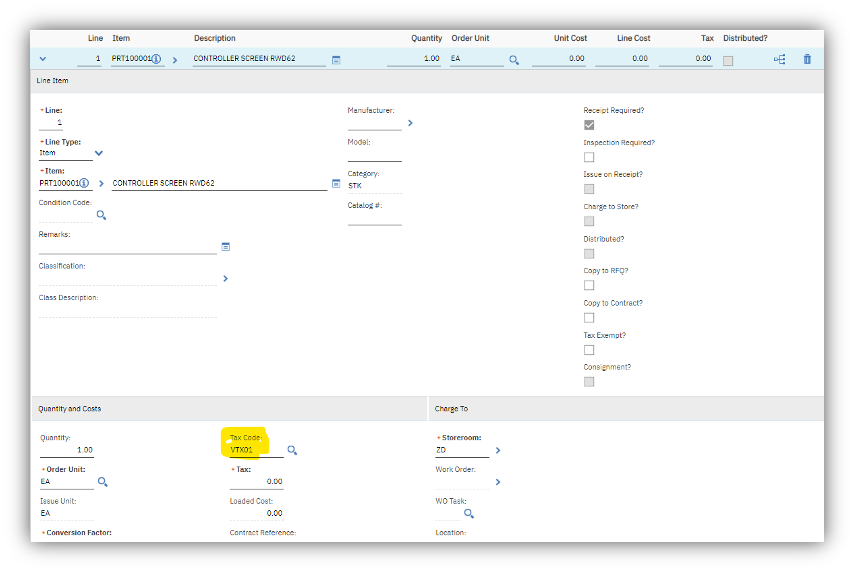

Removing the tax code from the Address code in Organization application

When a PR is created with the above set of data with the item ‘PRT100001’ selected in the PR line, Maximo updates the tax code VTX01 based on the Item/Vendor combination.

| Order | Source | Address | Item | Vendor | Tax Exempt | Tax Code |

| 1 | Ship to Address | LS | - | - | ||

| 2 | Item/Vendor | PRT100001 | 10013 | NO | - | |

| 3 | Company | ABC | - | GST | ||

| 4 | Item/Organisation | PRT100007 | NO | AVTO |

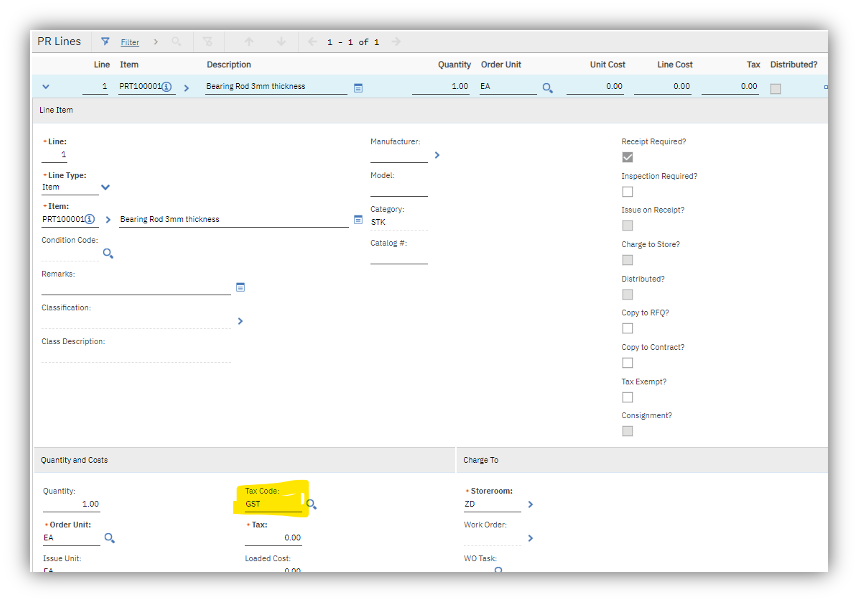

Removing tax code from Item & Vendor combination

When a PR is created with the above set of data with a PR line, Maximo updates the tax code as GST based on the Company details

| Order | Source | Address | Item | Vendor | Tax Exempt | Tax Code |

| 1 | Ship to Address | LS | - | - | ||

| 2 | Item/Vendor | PRT100001 | 10013 | NO | - | |

| 3 | Company | ABC | - | - | ||

| 4 | Item/Organisation | PRT100007 | NO | AVTO |

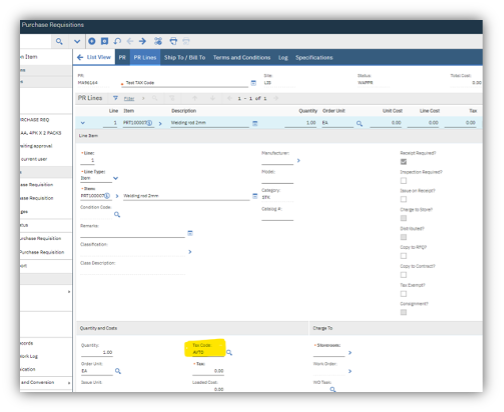

When a PR is created with the above set of data with a PR line, Maximo updates the tax code as AVTO based on the Item/Organization combination details

Arun Prasath

Lead Consultant

I am a Maximo Lead Consultant having extensive experience in requirement analysis, configuration, design, development, customizations, integration, testing, implementation and support of IBM Maximo Enterprise Asset management versions of Maximo V4.1, V5.2, V6.x and V7.x across multiple verticals like Manufacturing, Automotive, Oil & Gas & Landscaping/agricultural sector.

Stay up-to-date with the latest news and receive notifications right to your inbox when new articles are published by subscribing now.